💰Onchain P2P System

iExchange offers Traders a decentralized P2P platform to convert crypto to fiat & vice versa using a decentralized wallet. Traders & Merchants settle trades via smart contracts, with validators (settlers) attesting to transaction accuracy.

This will enable seamless crypto conversion to fiat and vice versa, fully decentralized on our exchange.

Features

Onchain P2P (Core feature)

P2P SDK Client (Core feature)

Protocol & Flow

Register Merchant & Settler Flow

Ensure Connect wallet

Initiate Registration

Provide KYC Details

Sign and Send Transaction

Stake Flow

Ensure Connect Wallet

Enter Amount to Stake

Approve contract to transfer erc20 token for stake

Sign and Send Transaction

Create Offer Flow

Ensure Connect Wallet

Enter Offer Details

Approve contract to transfer erc20 token for stake

Sign and Send Transaction

Delete Offer Flow

Ensure Connect Wallet

Select Offer to Delete and Confirm

Sign and Send Transaction

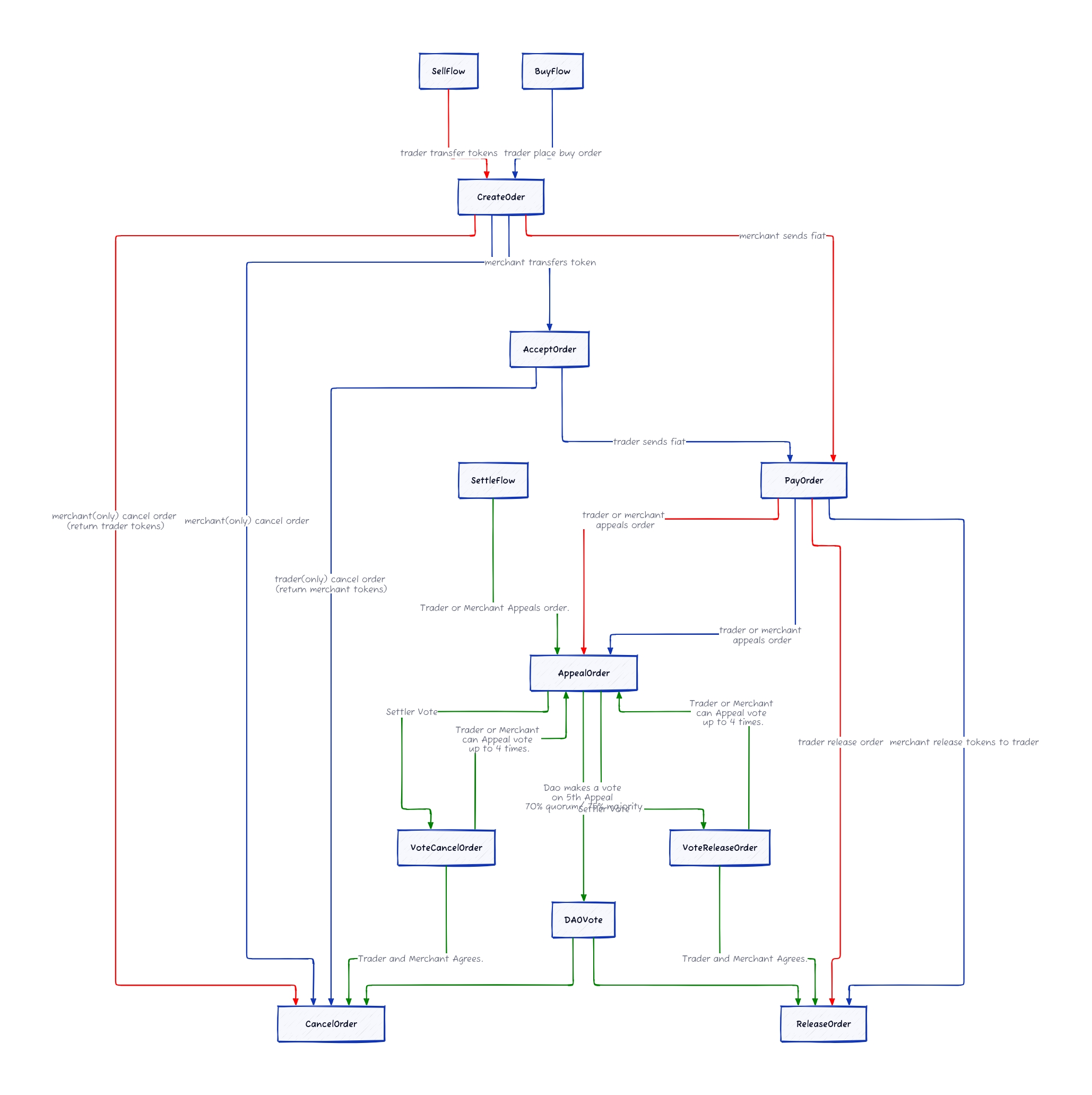

Create Order Flow

An order can either be a buy order or a sell order

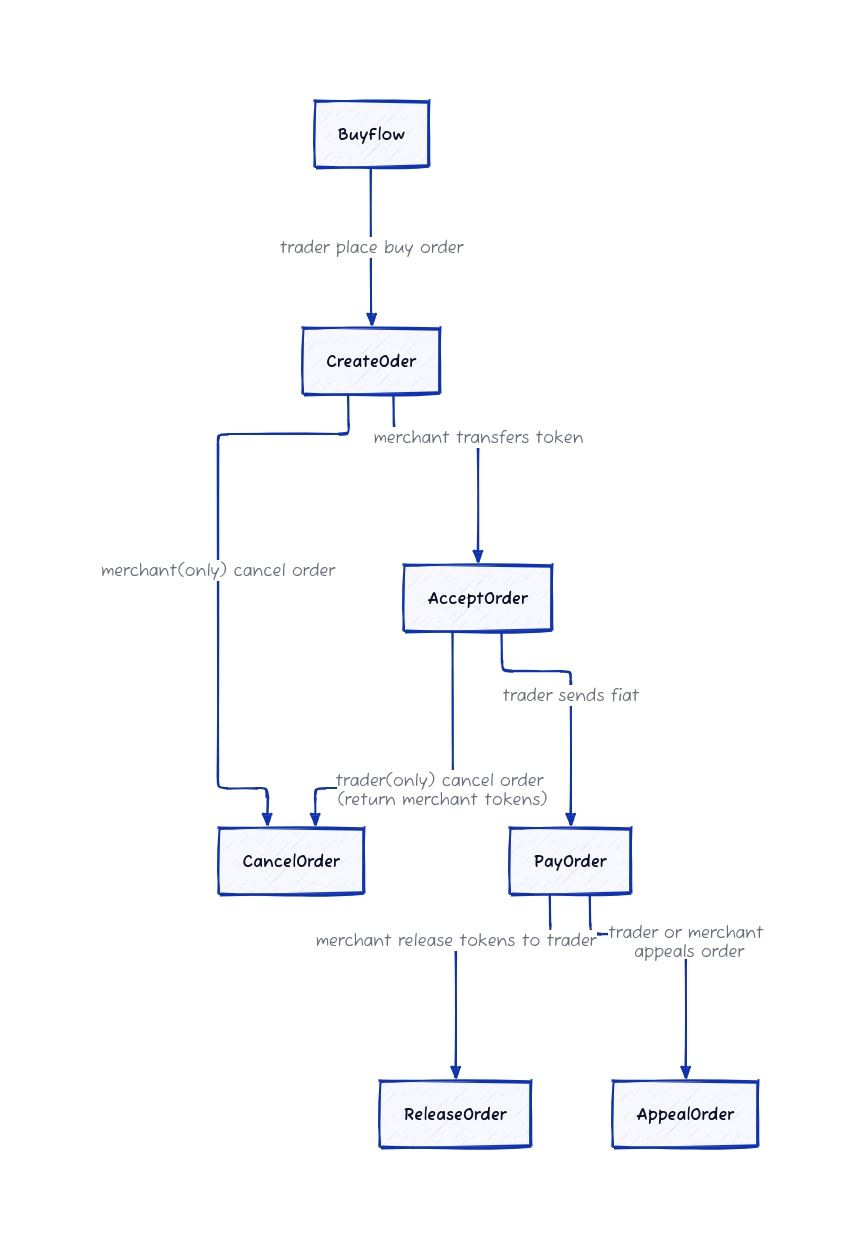

Buy Flow (Summary)

Ensure Connect Wallet

The trader will see a list of offers listed from the smart contract.

The trader will place the order to the smart contract. (Sign and Send Transaction)

The seller will confirm the order prompting the trader to send fiat to the seller. They can also decide to cancel. (Sign and Send Transaction)

The trader will confirm they've sent fiat to the smart contract. (Sign and Send Transaction)

The seller will see the order and confirm receipt to the smart contract. (Sign and Send Transaction)

Crypto will be automatically released to the trade.

In case of dispute, several settlers are invited to investigate and vote.

Buy Flow (Contract Specification)

Trader places a buy order by calling

CreateOrderTokens are transferred from the Merchant to the Contract

Merchant can see available orders and decide to accept(

acceptOrder) or cancel(cancelOrder)If Merchant accepts the buy order(

acceptOrder), Trader will then be prompted to send fiat. Here, Merchant cannot cannot cancel the order after he has accpeted it.Trader can also decide to cancel order(

cancelOrder) here after Merchant has accepted it(before Trader pays order), tokens will then be released back to the MerchantAfter Trader has sent fiat, Trader calls

payOrderprompting Merchant to release tokensFinally, If Merchant confirms fiat has been received,

releaseOrderis then triggered and tokens are sent to the traders wallet.

Buy Flow Disputes

In a case of a disagreement between a Merchant and a Trader:

A Merchant can open an appeal(

appealOrder) when he thinks trader did not send fiat but has calledpayOrder.A Trader can also call for an appeal when he thinks the Merchant did not release tokens after calling

payOrder

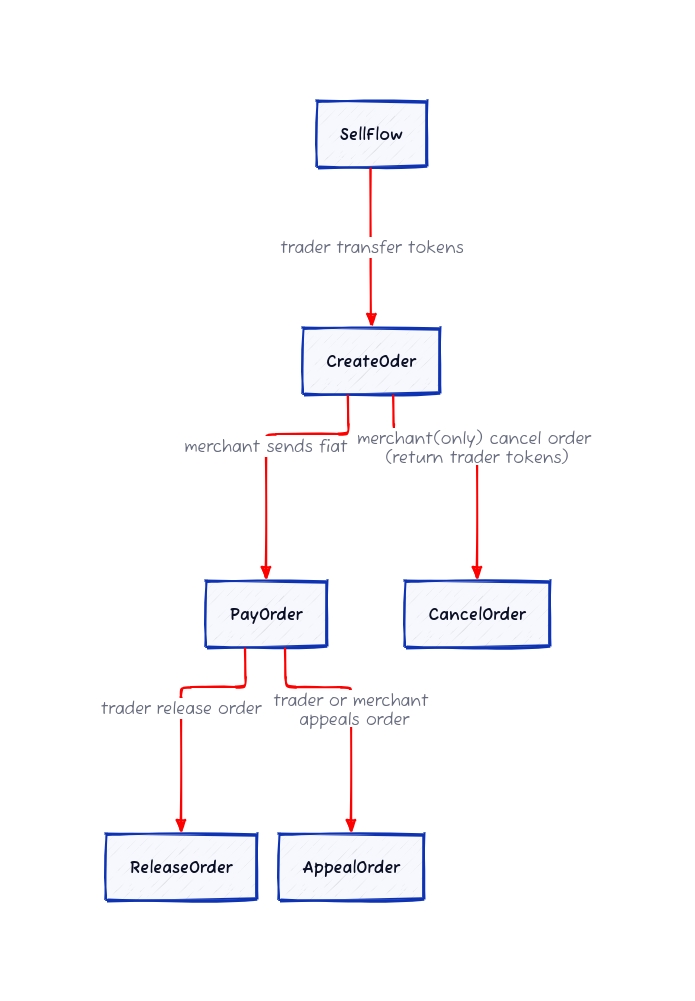

Sell Flow (Summary)

Ensure Connect Wallet

The trader will see a list of offers listed from the smart contract.

The trader will place the order by sending crypto to the smart contract. (Sign and Send Transaction) (erc20 token approval needed)

The buyer will see the order and send fiat. They can also decide to cancel.

The buyer will confirm they’ve sent fiat to the smart contract. (Sign and Send Transaction)

The trader will confirm receipt to the smart contract. (Sign and Send Transaction)

Money will be automatically released to the buyer.

In case of dispute, several settlers are invited to investigate and vote.

Sell Flow(Contract Specification)

Trader places a sell order by calling

CreateOrderand transfers tokens to the ContractMerchant sees a trader's order to sell tokens. Merchant can decide to cancel(

cancelOrder) or accept the order.If Merchant accepts the order, Merchant must send fiat to the Trader and then call

payOrderprompting Trader to release token.Trader after confirming fiat will then call

releaseOrderfor contract to release tokens to the Merchant

Sell Flow Disputes

In a case of a disagreement between a Merchant and a Trader:

A Trader can open an appeal(

appealOrder). When he thinks the Merchant did not send fiat but has calledpayOrder.A Merchant can also call for an appeal(

appealOrder) when he thinks the Trader has received fiat but did not release tokens after callingpayOrder.

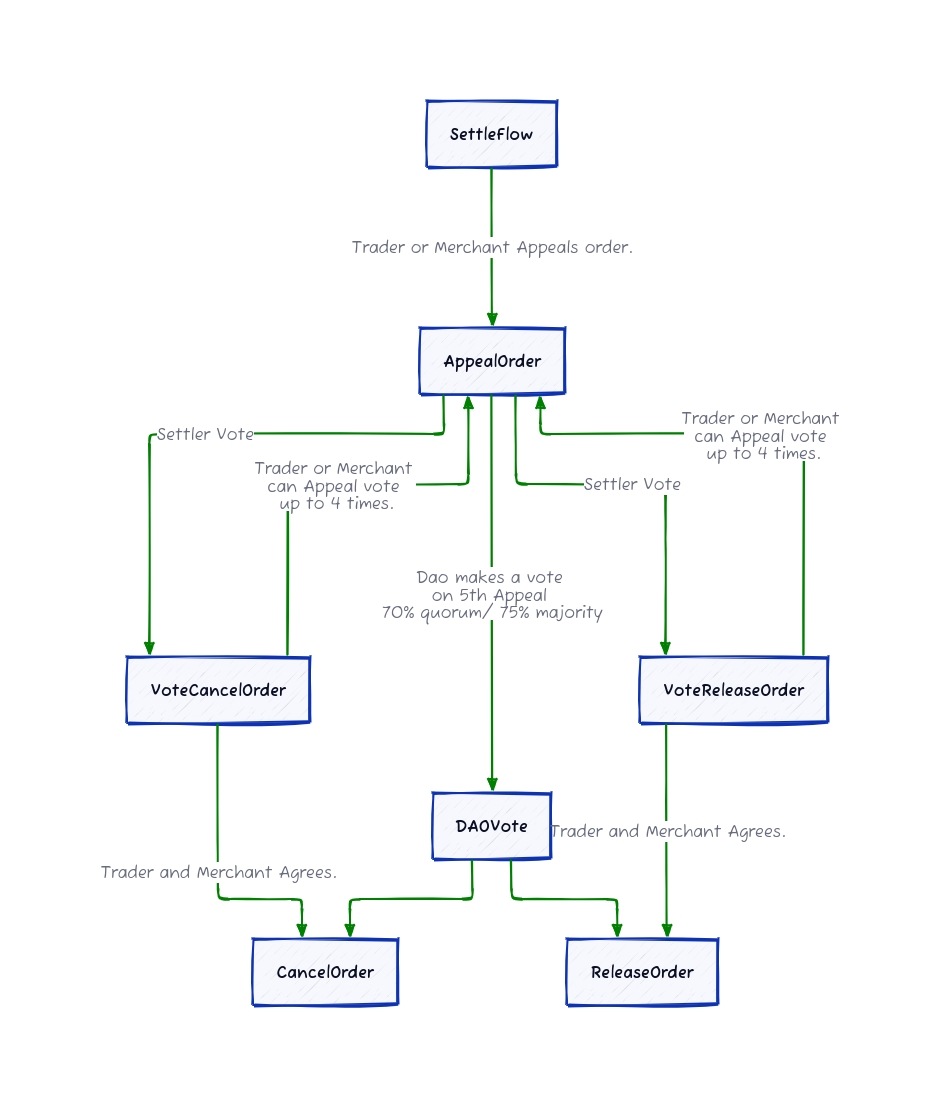

Settling Flow (Summary)

In case there is a dispute over whether fiat is sent, either party in the trade can opt for an appeal. A settler will be invited to settle the situation.

After the initial appeal, a settler is invited to oversee the situation.

The settler decides which party is not guilty by voting to either cancel or release the token.

If either party does not agree they can opt for another appeal.

An Appeal can happen 4 times max.

If there is still a misunderstanding it will be open for the entire DAO to also make their decision.

The majority decision of the DAO is final. 70% quorum with 75% majority is required.

Settlers get rewarded. The reward is a fraction of the penalty.

DAO gets rewarded if they end up participating.

Penalty is charged to the guilty party.

Settling Flow (Contract Specifications)

To settle appeals:

A Trader or Merchant first appeals an order (

appealOrder)A Settler is invited to investigate and cast a vote. A settler can vote for an order to be canceled (

voteCancelOrder) or an order to be released (voteReleaseOrder)If both Trader and Merchant agree on the Settler's vote, the order is then canceled (

cancelOrder) or released (releaseOrder)In the event of a disagreement, both Trader and Merchant can appeal the voting decision. A new Settler will then be invited to cast new votes. This process can happen a maximum of 4 times.

On the 5th time, the voting will be left for the DAO (

daoVote) who's decision will be final either to cancel the order (cancelOrder) or release the order (releaseOrder)

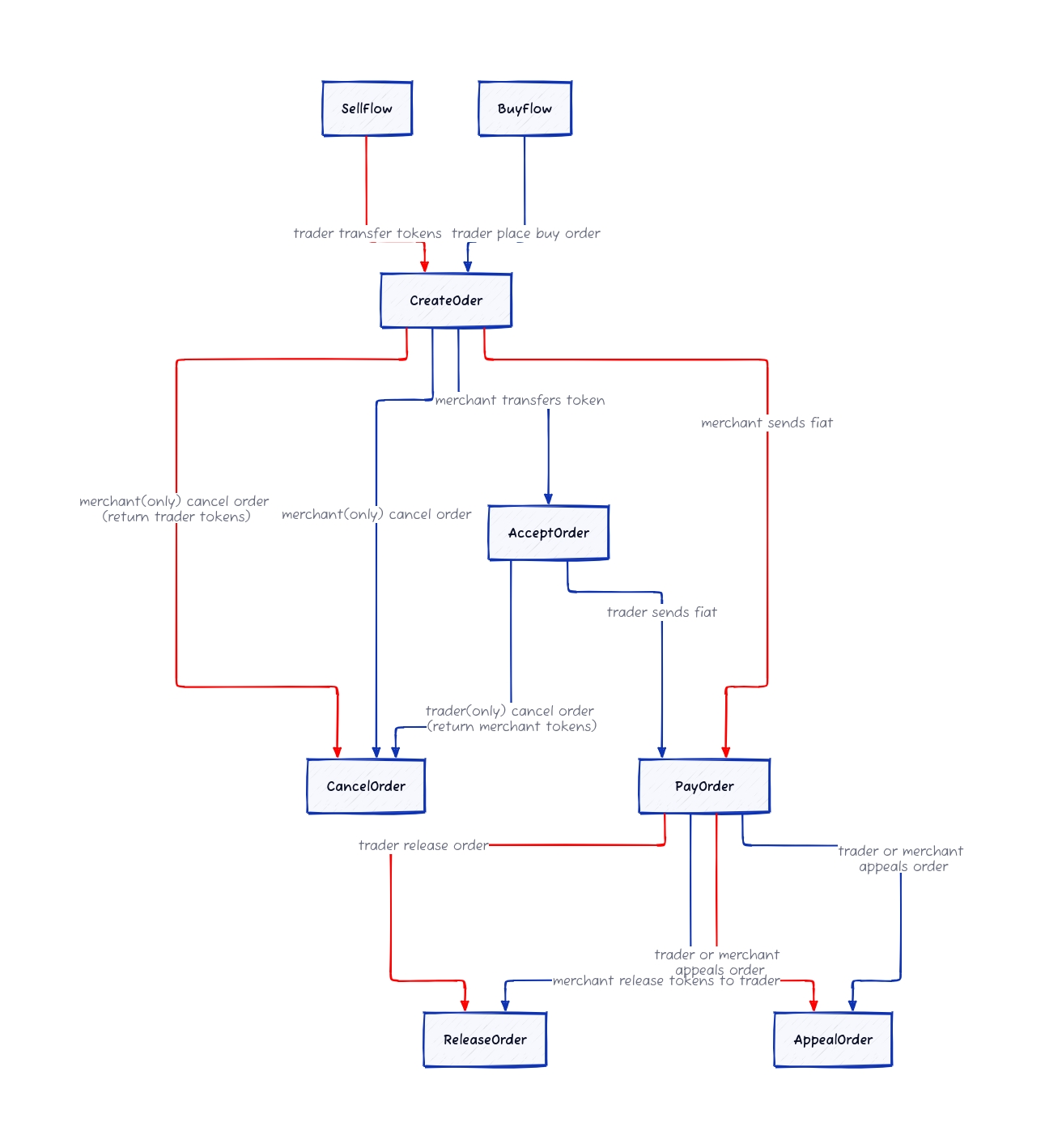

High Level Overview

Buy and Sell Flow Interactions

Buy, Sell and Settlement Interactions

DAO

The DAO is automatically comprised of all merchants, traders and settlers. All of these actors are eligible to vote on issues as long as the following conditions are met.

Member has completed at least KYC level2

Member has reputation score > 0

The weight of a member's vote is linearly determined by their reputation score and KYC vote

Reputation

Reputation scores can increase or decrease based on the behavior of an actor.

Increase

Successful trade with no appeals both parties are awarded

Correct judging by settler. At the end of the settling process, a correct judge is part of the majority.

Decrease

Guilty party in an appeal is punished by deduction.

Wrong judging by settler. At the end of the settling process, a wrong judge is part of the minority.

Penalty

Settler

If a settler is caught being dishonest, 50% of their stake will be slashed.

Also, a settler must have a stake of at least 20% of the amount on the trade to be able to settle the trade.

For example, if a trade is valued at 1000 usdt, the settler must have a stake of 200 usdt.

A settler can only settle trades involving the tokens they have staked.

Trader

A trader can be a buyer or a seller.

A seller can only sell 90% of the tokens in their possession. The remaining will be used as a stake to be slashed in the event of any dishonest behavior.

A dishonest buyer will only receive 90% of the intended amount to be received.

Depending on the actor in question, the penalty is slashed from different sources. In any case, their reputation is slashed to 0.

Merchant

If a merchant is caught being dishonest, 50% of their stake will be slashed.

Also, a merchant must have a stake of at least 100% of the amount on the trade to be able to settle the trade.

For example, if a trade is valued at 1000 usdt, the merchant must have a stake of 1000 usdt.

A merchant can only trade tokens they have staked.

Entities

Actors

Merchant

Trader

Settler

Abstract

Offer

Order

Payment Method

Payment Details

Appeal

AppealVote

Last updated